> Continuous Improvement Articles

The Surprising Truth about Automotive Quality

A few months back I posted an article questioning Toyota’s supremacy in quality and in Lean in general. Don’t misunderstand me—I still think Toyota is great at what they do. They have a lot to teach, but I think other companies have taken what Toyota does to heart and applied it to their own processes far more than most people believe. It appears that Toyota has lost ground not because of anything Toyota did (2010 notwithstanding), but rather because the competition has caught up. So, let’s take a look at what has happened in automotive quality over the last several years.

With any discussion of quality, you run into a big challenge in determining what, exactly, quality is. Deming talks a lot about operational definitions in Out of the Crisis. That basically means you can’t use vague terms for things. You have to be precise. So rather than get into the monumental task of trying to define it myself, I am going to use the J.D. Power and Associates Initial Quality Survey for my operational definition. One reason is that it is based on customer perceptions, which is really what quality is ultimately all about. (More about quality… Quality is supremely hard to define. Read about the many facets of quality in our Lean Dictionary.)

The second is that the data is readily available. I’m breaking one of the rules I normally teach teams about data collection. I tell them to use the right data, not the available data. Fortunately, in this instance, the available data is pretty close to what I need. Some might argue that the quality window for the initial quality survey is too small. They might feel that initial quality doesn’t necessarily mean a car will last a long time. I am betting, though, that there is at least some correlation between initial quality and long-term durability.

Finally, the data spans several years, so it is easy to see trends. So one night when I was bored, I spent a few hours tracking down the last few years’ worth of data and putting it into a table. The results were a bit surprising to me. (By the way, let’s focus on the information I gathered here, not my choice about how I entertain myself…)

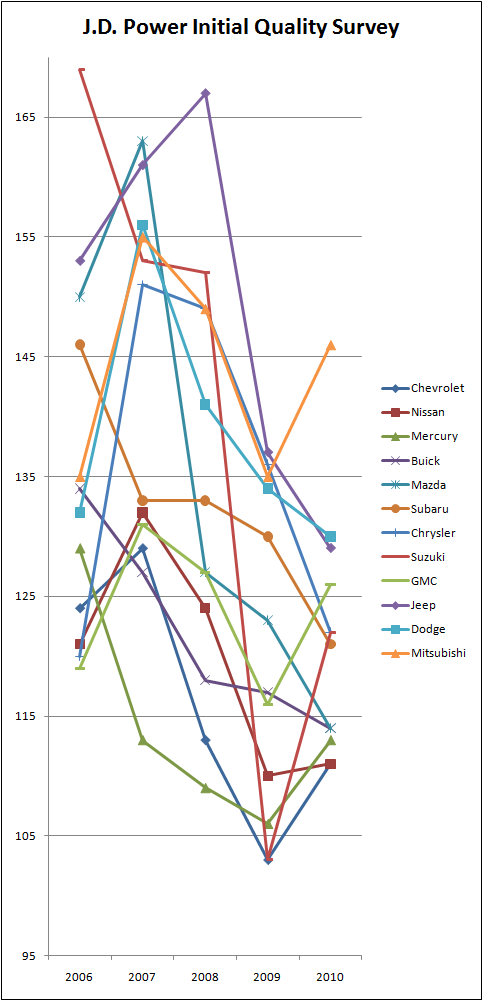

To better compare the data, I decided to separate out the luxury cars from the mainstream vehicles. The crop of luxury vehicles dominated the 2010 list, holding 7 of the top ten spots. Because of the substantial price differences, though, I didn’t want to be comparing apples and oranges.

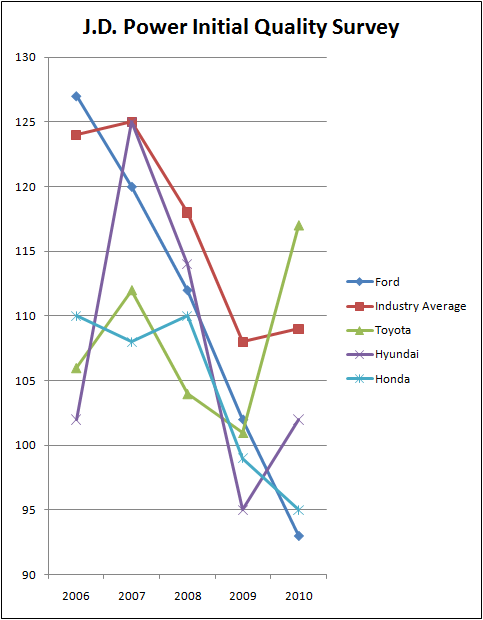

With that done, there are four standouts. Ford, Toyota, Hyundai, and Honda have all done quite well of late. Of note, I am giving Toyota a bye on 2010 where they were worse than the industry average. They’ve got a great track record, and I suspect much of the inflated score they posted was due to the negative publicity. I’d go out on a limb and bet that many owners scrutinized their cars far more because of the bad press, and that scrutiny undoubtedly affected Toyota’s score. Not to say there wasn’t a real problem with some vehicles, but perception is reality in quality.

So, let’s go over the surprises…

Surprise #1: Ford is coming on strong.

I am personally biased against Ford. I own a ’97 Explorer, now with nearly 160K miles on it. When I first bought it, I had a recurring problem with it intermittently not starting. On some occasions, it would start again if I waited a few minutes. Sometimes, it would take a few hours. But it always started again within a day.

I begged dealers six times to change out the ignition module (I’m not sure if that is actually the right name for the part), but they could never replicate the problem at the dealership, so nobody would spend the money to replace it. Finally, on my seventh trip over the years, (right after the warranty expired, of course), I got a dealer to swap out the part I’d been asking about, and it has run perfectly since then. Needless to say, my sample size of one has me down on Ford.

But the data in the chart above is pretty clear. Ford has been coming on like gangbusters, and now leads the non-luxury pack. In fact, Ford is the only one of the four I mentioned above that has gotten better every year since 2006. If you are familiar with control charts, long runs indicate something other than random chance is at work.

In addition, the score of 93 that Ford posted was the best of any mainstream winner during the five years of data I included in my research. (Note: Porsche had the overall lowest score at 83.) Judging by the trends, it is probably the best quality score ever for a non-luxury nameplate.

Despite my personal experience with Ford, I will admit to one thing about my Explorer. My Lean background prevents me from making a change just for the sake of change. There’s got to be a reason. So, I keep driving that old Ford now, praying it will break down so I can get a newer, spiffier model. But since they finally solved that recurring problem, the thing just keeps on running…

Surprise #2: Hyundai is inexpensive, but not cheap.

I never had the impression of Hyundai as a high-quality car, but the numbers are pretty clear. Hyundai is undoubtedly the champion of quality bang for the buck. And they even led the non-luxury pack in 2006 and 2009—the only two time winner in the last five surveys.

Surprise #3: Honda had been quietly on par with Toyota for quite a few years now.

Honda doesn’t get a lot of hype for its quality in the Lean community, but it has been rivaling Toyota for several years now. And they’ve been pretty profitable during that time as well.

Surprise #4: Toyota has only been at the top of the list once since 2006.

If you’ve been reading the Lean forums over the last several years, you might be under the impression that Toyota is light years ahead of the competition. In truth, it has worn the J.D.Power crown only once in the last five years. (Honda and Ford also topped the list once each, and Hyundai had the aforementioned two wins.)

Probably even more surprising is that both Honda and Hyundai have ranked better than Toyota 3 out of the 5 years shown the chart.

Surprise #5: US manufacturers topped imports for the first time in 2010.

In the 24 years of the survey, 2010 was the first time that US manufactures topped imports on the initial quality survey. The fact that it happened this year despite the continuing perception of US automakers as having bad quality is surprising, but more surprising is that it has never happened before.

Surprise #6: Overall quality is getting better.

Again, this is an issue of perception. The general feeling with consumers—the vocal ones at least—is that modern manufacturers scrimp and cut corners, and trade quality for profit. The numbers show that is not the case. Overall quality is continuously improving. (I talk about this perception in detail in my book, Whaddaya Mean I Gotta Be Lean?)

Surprise #7: Not all Japanese auto manufacturers are great.

The emphasis on Toyota within the Lean community translates somewhat to a perception that all Japanese manufacturers are outstanding. The following chart shows several of the mainstream Japanese and American auto manufacturers. The surprise is that they are mixed rather well. Because of the number of automakers on the list, the chart below looks rather jumbled. You can see the mix, though in the key. It is sorted in order from best quality to worst quality based on the 2010 numbers.

Now, of course, quality is only part of Lean. You also have to be profitable, and the J.D. Power survey doesn’t address that. But quality certainly plays a big role in becoming profitable. Spending less on warranty claims helps the bottom line, and being perceived as a high-quality car helps sales.

And anyone who has ever worked in a factory certainly knows that quality and productivity are closely related. Refined, repeatable processes produce good parts, and they also reduce waste. Both are great for the bottom line.

It will be interesting to see how things shake out over the next several years. When Toyota was perceived as being the undisputed quality leader, it was able to demand a premium for its cars. As perceptions start to shift, it will be harder for Toyota to charge more than its rivals. And there are some indications that resale prices on Toyota vehicles are already starting to lose some of their luster. That will also make it hard to keep new car prices higher than comparable competitors. In fact, Toyota seems to be offering more incentives lately. Anecdotally, I am seeing more low APR offers on Toyota ads than ever.

So what do you think? Were you surprised by any of the numbers in the surveys? Do you even think the survey is a relevant measure of quality, and if not, what would be a better way? I’d love to hear your thoughts.

0 Comments