> Continuous Improvement Articles

Free (Lean) Tax Advice

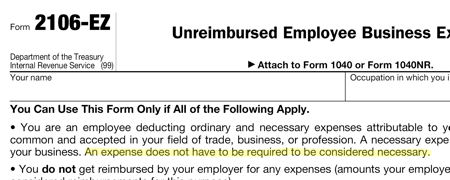

I saw a blurb in Forbes magazine that I just had to check out. It referred to an instruction located on the US tax form 2106-EZ.

The instruction says, “An expense does not have to be required to be considered necessary.” I have to confess, I don’t have the brainpower to figure out what expenses might not be required, but would still be necessary.

It is easy to hear about things like this in the government because millions of people see the documents. Your standard work, policies, work instructions, and the reams of other documents in your organization, though, don’t have the same scrutiny. But that doesn’t mean that you don’t have the same types of errors.

I recommend that you…

- Proff red you’re wirk. One trick is to read the last sentence first, and work backwards through the document. It removes context, so your brain doesn’t fill in the blanks. A second tip is to wait a bit before proofing. The gap in time means you are reading and not remembering.

- Get an editor. Get someone to proof your work for you. While not always practical, it is a good idea to do this whenever possible. Two brains are better than one.

- Follow the instructions. Actually use the instructions you wrote to do the work. You’ll recognize shortcomings when you put it to use in gemba instead of in the office.

- Use visuals. Pictures say in one image what takes a thousand words to speak. Or so the expression goes. In practice, though, images add understanding that word often can’t. (Shameless Plug…We offer a Lean Lego exercise that shows how visuals can be easier to follow than written instructions.)

By the way, good luck with the upcoming tax deadline.

0 Comments